The Business Side of Selling

with

Cathy Wetzel and Janie Jones

Have you been making a list of things you need to know and do before classifying your glasswork a “Business”? Or perhaps you just can’t make up your mind whether you should stay small or go big? Cathy and Janie will help you with that list and try to give information that will help you with your decision.

After the Demo Update!

(If you missed it, remember that members can watch the recorded demo on the Facebook Members’ Page, check it out! And if you aren’t a member but would like to be, visit the Membership page.)

Janie Jones gave us many things to consider when we are deciding if selling as a business is right for us. Over the years she acquired experience doing retail shows selling her glass. She shared aspects of the business side of things that could easily be overlooked for someone just getting started, but important to be considered when making the decision to sell or not.

The first thing Janie suggested we consider is whether or not we are actually making money when selling beads. She went on to talk about several things affecting that equation. There are obvious product expenses such as buying glass, but there are also many less obvious expenses to be factored into the equation.

Record keeping is very important, and Janie discussed the specifics of keeping good records. She gave us some information on various computer programs we might find useful and went over some other areas such as these examples:

- Federal and State Income Tax

- Sales Tax

- How much it costs to run a kiln

- Deciding which shows to do (some are better than others)

After discussing some of the things we need to think about before we make a decision, Janie said the best advice she could give us was to “Get a good accountant! Tax laws change every year.”

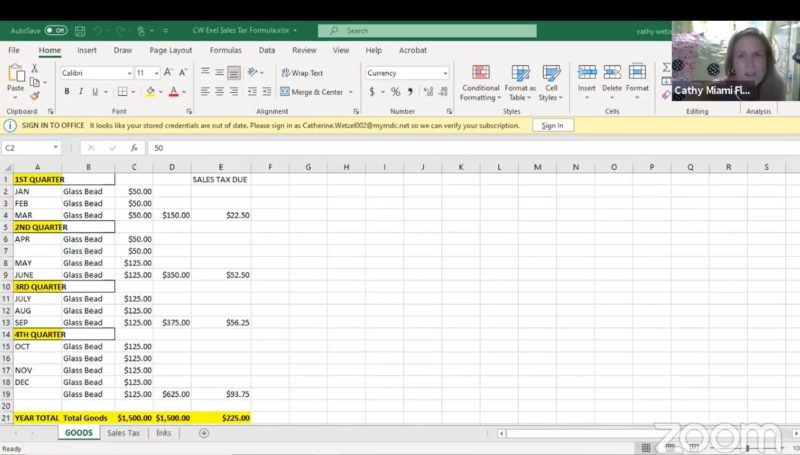

Next, Cathy Wetzel demonstrated and explained a spreadsheet she created to share with the group. The Excel spreadsheet can be edited to fit each person’s requirements with regard to their state tax rates. When you enter your sales for a time period for example, the chart will automatically fill in a column with the tax owed on the sales that are entered, and keep a running total for ease of tax filing.

Addendum: In a comment on the recording, Janie clarified her recorded answer on a question that was asked during the Q&A: “Could glass purchased 10 years ago be claimed as a business expense?” Janie said “Yes it can, but there are stipulations. Was there a business 10 years ago? If so, the expense could be claimed by filing an amendment to that year’s tax returns.”

She continued, “I am not an accountant but it’s my understanding that an expense from one year may not be claimed in a different year. And if there was no business 10 years ago, then glass purchased then would have been for a hobby.” Janie’s recommendation is to seek advice from your accountant to make sure you are following the rules in any situation.

Thank you Janie Jones and Cathy Wetzel, for sharing your time and expertise with us!

You can see some of Cathy’s glass and other artwork on her website.

Dragon members have access to this recorded presentation, found on our Facebook Members Group.